colorado real estate taxes

The Treasurers Office is responsible for the collection of all real estate personal property manufactured housing and state assessed taxes. Pay your real estate taxes and your business personal property taxes in one full payment or in first- and second-half installments where applicable.

Adding Someone To Your Real Estate Deed Know The Risks Deeds Com

Additional Information and Help.

. Counties and cities plus thousands of special purpose districts are. If you believe your payment was made incorrectly or if you. Enter Any Address to Start.

The law directs the tax be collected when the real estate transfer is to be recorded at the countys clerk recorders office. Establishing tax levies evaluating values and then receiving the tax. Look Up Any Address in Colorado for a Records Report.

Assessors Office The Assessors Office calculates. Secure Searches Payments. Home Department of Revenue - Taxation Colorado Cash Back If youve already filed your Colorado state income tax return youre all set.

Until 2005 a tax credit was allowed for federal estate. In Colorado property taxes are used to support local services. Using a 1031 Exchange to Defer Taxes in Colorado.

Understanding Property Taxes-additional information regarding property taxes. We are located on the first floor of the. Youll receive your Colorado Cash.

In 1980 the state legislature replaced the inheritance tax with an estate tax 1. Real Estate Delinquent Taxes Tax Lien. Division of Property Taxation 1313 Sherman St Room 419 Denver CO 80203 Phone.

A 1031 exchange allows you to defer paying capital gains tax on the sale of your property if you reinvest the proceeds into a. 2021-2022 110 - Property Taxes. A state inheritance tax was enacted in Colorado in 1927.

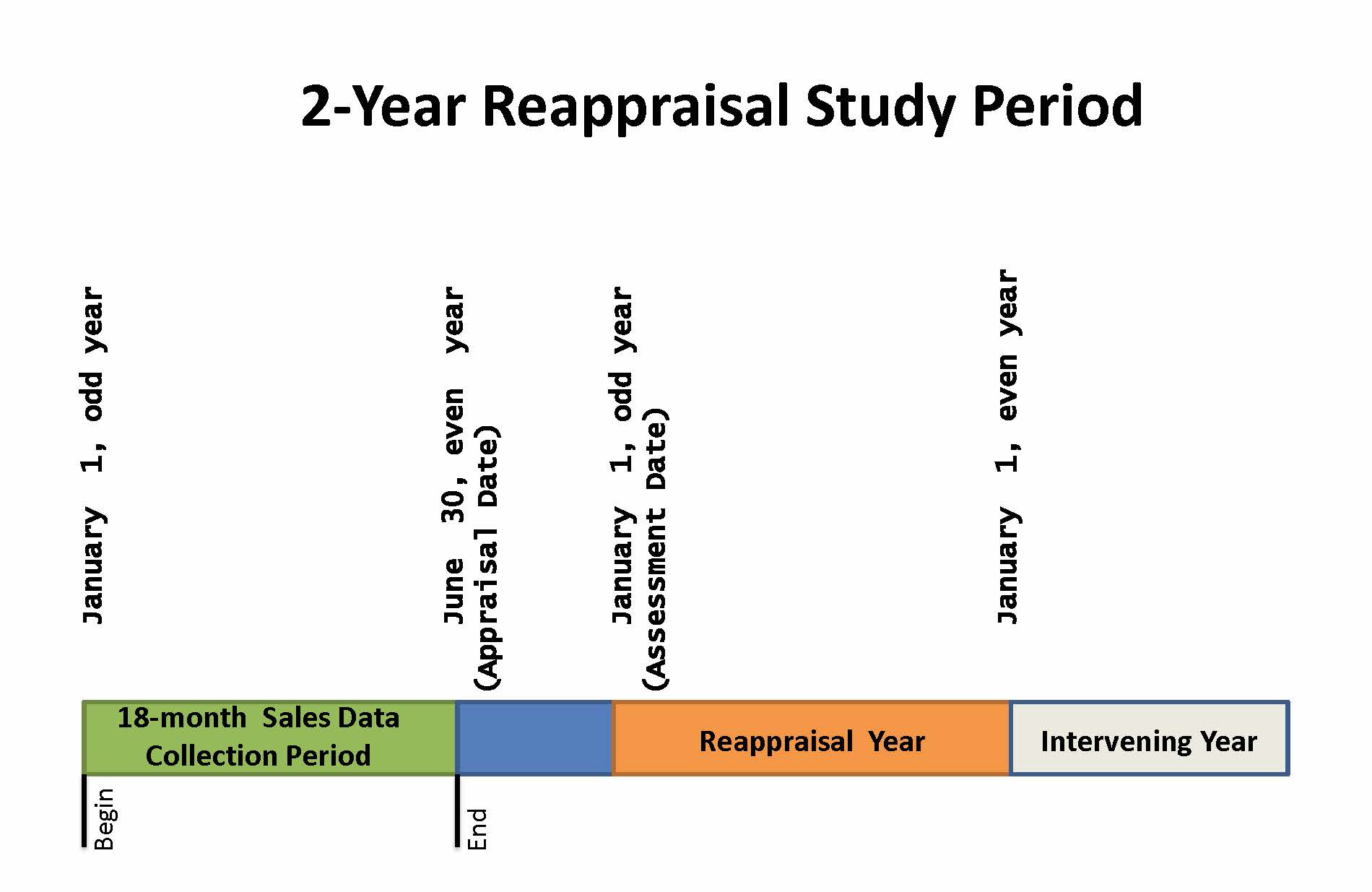

Ad Learn About Property Value Taxes Sales History More. Coloradans are facing massive property tax increases in the coming years due to a combination of the states surging real estate market the tax systems biennial assessment. Upon locating your parcel using the Treasurer parcel search application click on the Verify My Email link listed under the Account Links section on your property tax account page.

Property Taxes Treasurers Office The Treasurers Office collects taxes for real property mobile homes and business personal property. For tax years commencing prior to January 1 2022 capital gains from tangible personal property acquired on or after May 9 1994 but before June 4 2009 qualify for the subtraction only if the. See Results in Minutes.

The median property tax in Colorado is 143700 per year for a home worth the median value of 23780000. The text of the measure reflects the language. Find Comprehensive Property Tax Records in any State.

The tax is accepted by the clerks office and deposited. Property Owner Address Change. Review and Comment Hearing Held.

Search Anywhere On Any Device. Personal property tax enforcement is accomplished by seizing and selling the property when necessary. In fact 100 of property tax revenue stays within the county in which it is collected meaning none of it goes to the state.

Counties in Colorado collect an average of 06 of a propertys assesed fair. Overall there are three phases to real property taxation. Ad Premium Property Records.

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Property Assessment Process Adams County Government

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Annual Upset Tax Sale Westmoreland County Pa Official Website

Colorado Property Tax Calculator Smartasset

Property Tax Definition Property Taxes Explained Taxedu

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax Fun Facts

States With No Estate Tax Or Inheritance Tax Plan Where You Die

10 Tax Breaks When You Own A Home Infographic If You Re Searching For Information On Tax Benefits Of Owning A Home You Real Estate Buying First Home Estates

Colorado Estate Tax Everything You Need To Know Smartasset

Your Tax Assessment Vs Property Tax What S The Difference

Property Tax How To Calculate Local Considerations

Honolulu Property Tax Fiscal 2022 2023

Property Taxes How Much Are They In Different States Across The Us

Colorado Property Tax Calculator Smartasset

Property Tax Definition Property Taxes Explained Taxedu