income tax rates 2022/23 scotland

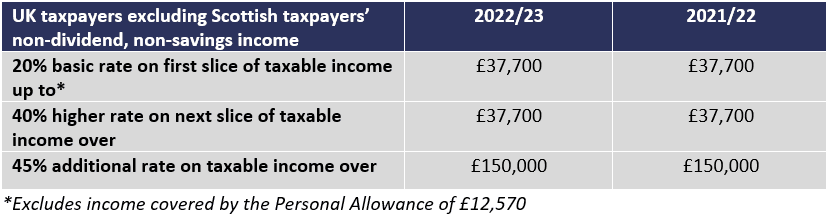

Those earning less than 27850 will pay slightly less income tax in 2022-23 than if they lived. You pay a different rate of tax for income from the tax year 6 April 2021 to 5 April 2022.

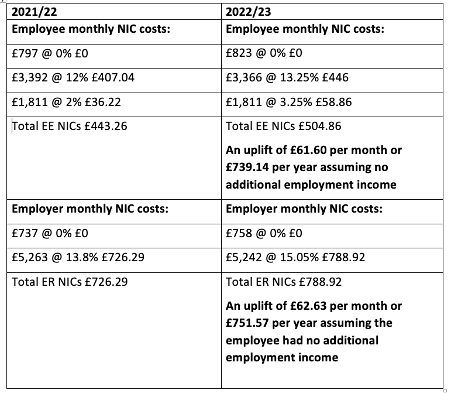

Payroll Year End Bulletin Spring 2022 Henderson Loggie

There were further amendments in 2019.

. Scottish basic rate - 10956 at 20 219120. Scottish basic rate - 10956 at 20 219120. A set of ready reckoners which show the estimated revenue impact of illustrative changes to Scottish.

If you are resident in Scotland your income tax will be as follows. This offer covers the period 202223. The table shows the 2022 to 2023 Scottish Income Tax rates you pay in each band if you have a standard Personal Allowance of 12570.

The Scottish Fiscal Commission have forecast that Income Tax will raise 13671 million in 2022-23 in Scotland. You do not get a Personal Allowance if you earn over. Employee earnings threshold for student loan plan 1.

On 25 February 2021 the Scottish Parliament set the following Income Tax rates and bands for 2021 to 2022 which will take effect from 6 April 2021. The legislation is here. Accounting and Bookkeeping Services.

Guide setting out key information about how the system of public finances in Scotland stands in 2022 to 2023 and how this system is changing. Scottish NHS nurses offered 5 pay deal for 2022 -23. If you wish to calculate your income tax in Scotland before the income tax rate change in 201718 you can use the pre 201718 Scottish Income Tax Calculator.

If your home is in. It will automatically calculate and deduct repayments from their pay. Scotland Non-Residents Income Tax Tables in 2022.

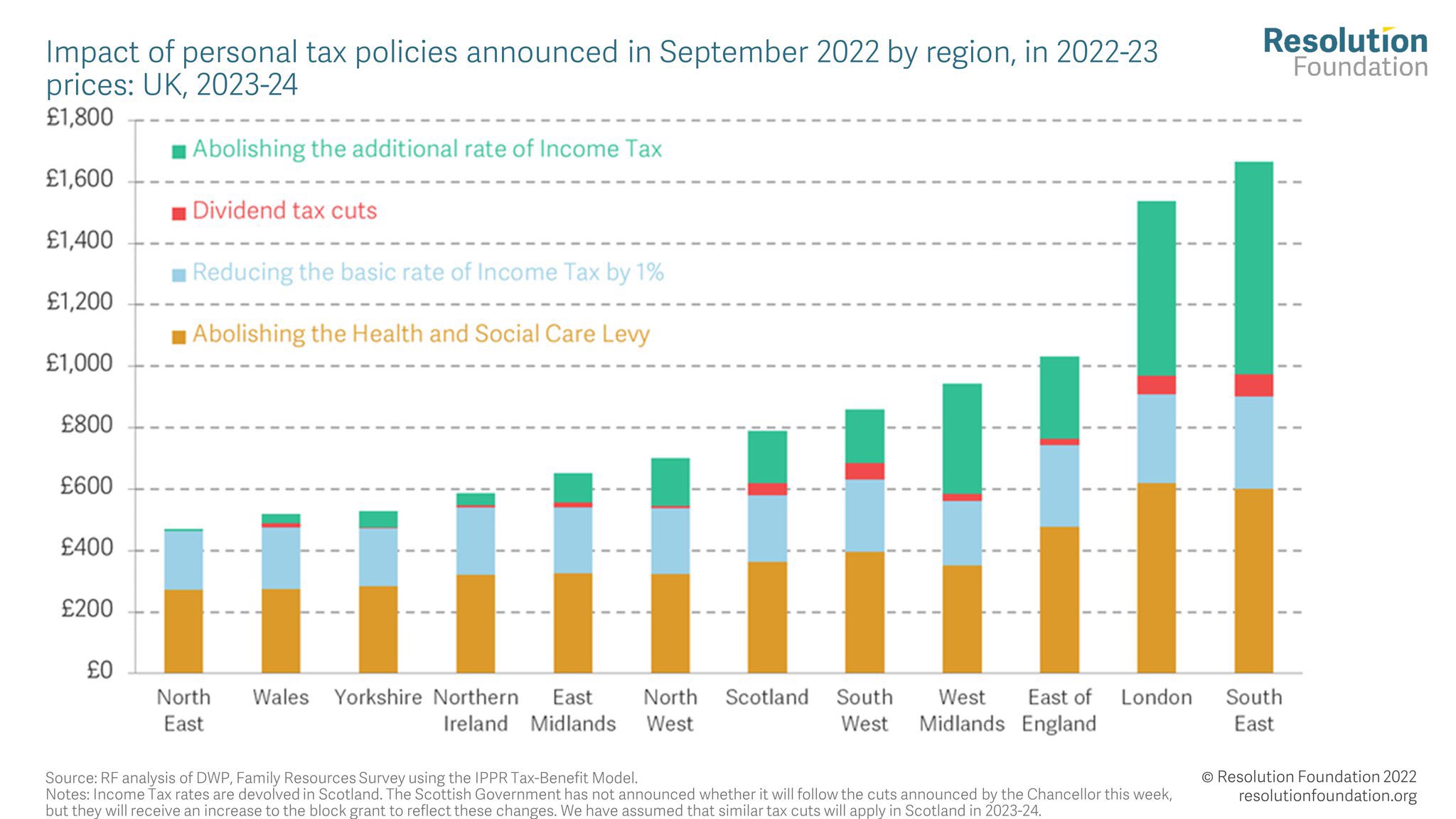

The rate of Income Tax you pay depends on how much of your taxable income is above your Personal Allowance in the tax year. Scottish income tax bands 202223 Scottish starter rate 19. D a higher rate of 41 charged on income above 31092 and up to a limit of 150000 and e a top rate of 46 charged on income above 150000.

12571 14732 2162 Scottish basic rate 20. Scottish starter rate - 2162 at 19 41078. Your Personal Allowance is the amount of.

All Tax Calculators on iCalculator are updated with the latest Tax Rates and Personal Allowances for 202223 tax year. Band Taxable income Tax rate. Income tax bands are different if you live in Scotland.

Scottish income tax rates 202223. If you are resident in Scotland your income tax will be as follows. ICalculator Scottish Tax Calculator is updated for the 202223 tax year.

Economy Money and tax Scottish Budget. 15 June 2022 By Gemma. HMRC have published separate Scottish payroll tax tables for tax years 201617 onwards to deal with the different Scottish higher rate threshold and now the five rates and.

Scottish starter rate - 2162 at 19 41078. Staff paid at least 1050 per hour and would involve a rise of slightly. 2022 to 2023 rate.

The current tax year is from 6 April 2022 to 5 April 2023. Income Tax Rates and Thresholds Annual Tax Rate. Proposed Income Tax Rates and Bands 2021-22 2022-23.

Reflected in the above table are tax rate changes from the 2018 Budget.

Tax Year 2022 2023 Resources Payadvice Uk

Here S Exactly How Much More Tax You Ll Have To Pay In Scotland Compared To The Rest Of The Uk Check Now The Scottish Sun

High Tax Rates In Scotland Bring In 200m Less Says Ifs Scotland The Times

Hmrc Tax Receipts And National Insurance Contributions For The Uk Monthly Bulletin Gov Uk

Income Tax Deductions Financial Year 2022 2023 Wealthtech Speaks

Scottish Budget 2022 2023 Sets Out Scottish Income Tax Changes Payadvice Uk

Sam Bright On Twitter A Thread Of Some Of The Shocking Stats Emerging From The Budget Someone Earning 1 Million A Year Will Be Receiving A 55k Tax Cut Twice The Average Uk

Scottish Budget 2022 2023 Sets Out Scottish Income Tax Changes Payadvice Uk

What Is Scottish Income Tax Low Incomes Tax Reform Group

Income Tax Slabs 2022 23 Live Updates Will Sitharaman Give Much Needed Relief To Middle Class This Year

Spring Budget Summary 2022 Kind Wealth

Scottish Income Tax 2022 23 What Might You Be Paying Bbc News

Scottish Income Tax Where Are We Now Anderson Strathern

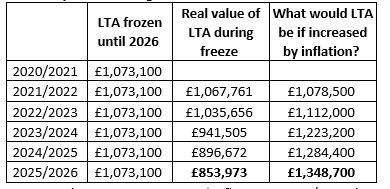

End Big Freeze On Income Tax And Pension Thresholds

2022 23 Uk Income Tax And National Insurance Rates

Scottish Income Tax Distributional Analysis 2022 2023 Gov Scot

Payroll Year End Bulletin Spring 2022 Henderson Loggie

Mini Budget Latest Kwasi Kwarteng Announces Tax Cuts Worth 45bn